reverse sales tax calculator california

This Sales Tax Calculator And De-Calculator will calculate sales tax from an amount and tax or reverse calculate with the tax paid. Where Sales Tax is the dollar amount of sales tax paid Sales Tax Percent is the state sales tax as a percentage and Sales Tax Rate is the state sales tax as.

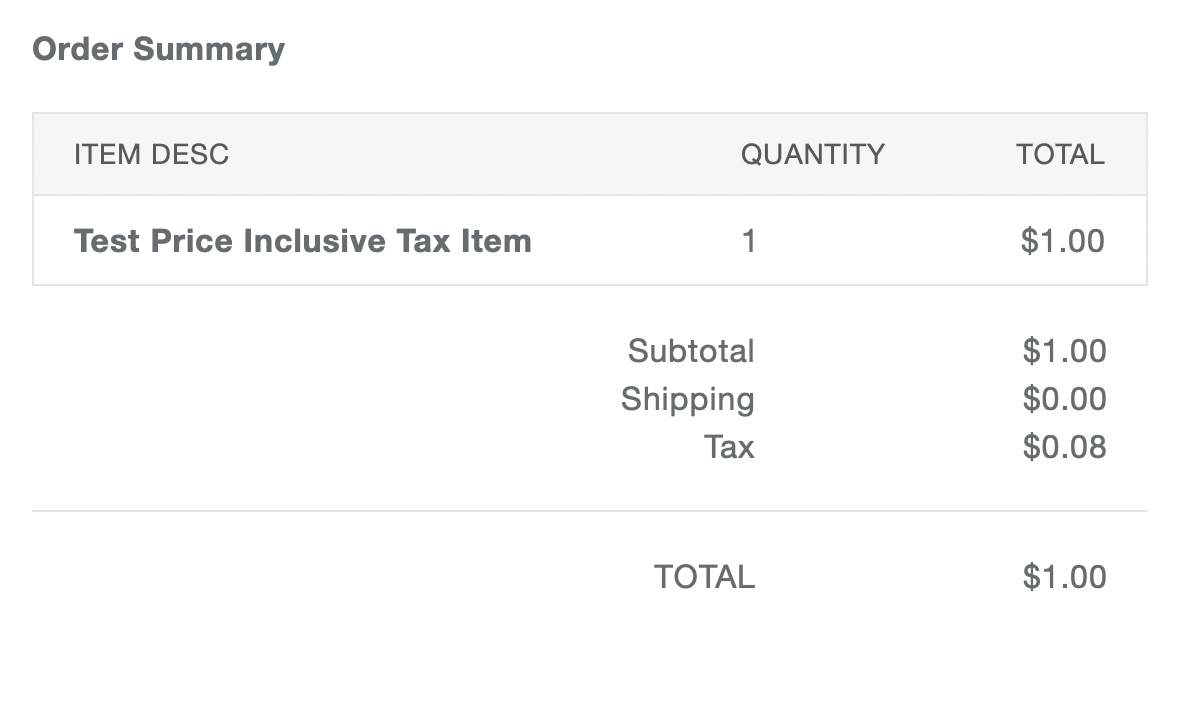

Automatically Collect Tax On Invoices Stripe Documentation

If the product is priced at lets say 100 USD then reverse sales tax works in the following way.

. 1788 rows Businesses impacted by recent California fires may qualify for extensions tax relief and more. Reverse Sales Tax Calculations. Amount with sales tax 1 GST and QST.

California has a 6 statewide sales tax rate but also has 469 local tax jurisdictions including cities towns counties and special districts that. Divide tax percentage by 100. The price of the coffee maker is 70 and your state sales tax is 65.

Here is the Sales Tax amount calculation formula. Amount without sales tax GST. Current hst gst and pst.

Current hst gst and pst. Here is how the total is calculated before sales tax. Simply enter the purchase price and the sales tax rate to.

To calculate the sales tax that is included in receipts from items subject to sales tax divide the receipts by 1 the sales tax rate. How do you calculate tax. Calculate sales tax using this free tool.

For example if the. 65 100 0065. Example for Showing Method of Reverse Sales Tax Reverse Calculator.

Please visit our State of Emergency Tax Relief page for. Sales Tax total value of sale x Sales Tax rate. Amount with sales tax 1 GST and QST rate combined100 or 114975 Amount without sales tax.

If your total receipt amount was 5798 and you paid 107 percent in sales tax youd simply plug those numbers into our calculator to find out that your original price before tax was 5737. You can calculate the reverse tax by dividing your tax receipt by 1 plus. Here is how the total is calculated before sales tax.

Home Top Free Apps. List price is 90 and tax percentage is 65. Multiply price by decimal.

Amount with sales tax 1 GST and QST rate combined100 or 114975 Amount without sales tax. Use our sales tax calculator to determine the amount of sales tax owed on a purchase. To calculate the sales tax backward from the total divide the total amount you received for the items subject to sales tax by 1 the sales tax rate.

If you want to know how much an item costs without the Sales Tax you might want to. The formula to calculate the reverse sales tax is Selling price Pre-tax price final price Post-tax price 1 sales tax. Amount without sales tax GST.

To calculate the sales tax backward from the total divide the total amount you received for the items subject to sales tax by 1 the sales tax rate. Businesses impacted by recent California fires may qualify for extensions tax relief and more. The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location.

Please visit our State of Emergency Tax Relief page for additional information.

Easiest Capital Gains Tax Calculator 2022 2021

How To Calculate Sales Tax Backwards From Total

Understanding California S Sales Tax

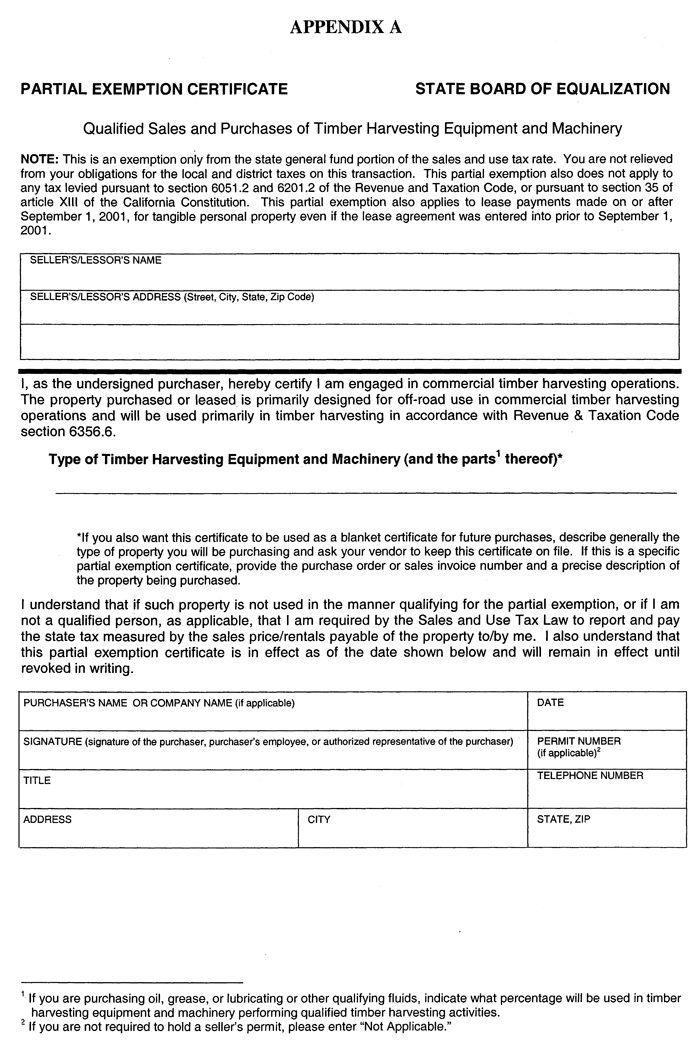

Sales And Use Tax Regulations Article 3

How To Calculate Sales Tax In Excel Tutorial Youtube

How To Easily Calculate Sales Tax Gst In Google Sheets Yagisanatode

California Sales Tax Calculator Reverse Sales Dremployee

California Proposes 16 8 Tax Rate Wealth Tax Again Time To Move

What Is A Reverse Mortgage Money Money

California Sales Tax Calculator And Local Rates 2021 Wise

How To Calculate Sales Tax Methods Examples Video Lesson Transcript Study Com

How To Pay Sales Tax For Small Business 6 Step Guide Chart

How To Calculate Sales Tax Backwards From Total

How To Calculate Cannabis Taxes At Your Dispensary

2022 2023 Tax Brackets Rates For Each Income Level

How To Calculate Sales Tax In Excel

Sales And Use Tax Regulations Article 3